Debt to Asset Ratio

Here is a listing of the City’s outstanding long-term bond issues as of June 30, 2015:

$11.8 million of General Obligation debt

$ 4.8 million of Full Faith and Credit debt

$ 0.8 million of Water Revenue Bonds

$17.4 million of Total Authorized Debt

To put this outstanding authorized debt amount into some perspective, the City's total assets expressed as historical cost, after accumulated depreciation, is $303 million.

West Linn's debt-to-total assets is 6.2 percent.

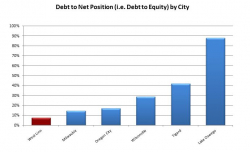

West Linn's debt-to-net position (i.e. debt-to-equity) is 6.9 percent.

Another perspective to measure this debt amount is the State of Oregon's maximum debt level allowed by ORS 287 for all cities. This State debt maximum says that cities may not have general obligation debt exceeding three percent of its real market value. For West Linn this maximum would be three percent of $3.5 billion or $104 million.

Debt levels of various other comparable cities are available below. Maintaining a healthy ratio of debt is an important tool in sound and prudent financial planning. Debt is one of the main vehicles that cities use to fund necessary improvements and other capital projects. Certainly, keeping your total debt amount in perspective with the value of your assets is important, not to mention keeping perspective with what others cities' debt loads are.

In summary, at just about seven percent of historical depreciated cost, West Linn's long-term debt-to-asset ratio is fiscally healthy, prudent, and financially responsible.