Oregonian Article: Property Tax Bills Will Go Up Even If Your Home's Market Value Falls

Property tax bills will go up even if your home's market value falls

By James Mayer, The Oregonian

September 27, 2009, 6:00PM

As you watched your home value plummet in this recession, at least you could look forward to a property tax break, right?

Wrong.

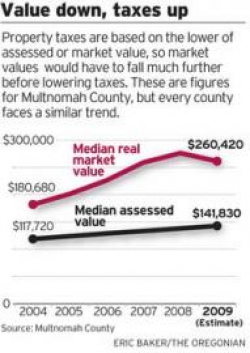

The tax bills that county assessors across the state will be sending out next month will likely show drops in the market value of most homes, but that won't translate into lower taxes.

"Surprise!" said Tom Linhares, executive director of the Multnomah County Tax Supervising and Conservation Commission, which monitors property taxes in the county.

Everyone is in the same boat, not just taxpayers in Multnomah County.

The primary reason can be found in the mysteries of Measure 50, a constitutional amendment approved by voters in 1997.

It reduced assessed values to 1995 levels, less 10 percent, and limited assessment growth to 3 percent per year, with exceptions for remodeling. That limited tax increases to 3 percent, plus voter-approved levies and bonds.

The measure, a response to rapidly rising taxes pegged to climbing values, forever divorced property taxes from market value. As property values continued to soar over the next decade, growing by 20 percent a year in some cases, assessed values crept along at 3 to 5 percent a year.

The only way falling home values could lower taxes is if market value falls below the assessed value -- and that's not likely to happen this year, or any time soon.

In most parts of the state, the assessed value is now about half the market value.

It's also important to note that market values are calculated as of Jan. 1, based on sales in the previous year. The drops in value in 2009, for instance, won't be reflected in the tax statements until October 2010.

In Multnomah County, the assessed value was slightly over 50 percent of market value last year. This year, officials estimate it will be about 55 percent, still a long way from 100 percent, the point where taxes would be affected.

As an example, let's say your home was valued at $300,000 last year, with an assessed value of $150,000. Say it dropped in value by 10 percent in 2008. The market value would be $270,000, and the assessed value would increase by 3 percent, to $154,500. Taxes go up. Even if the market value drops another 10 percent in 2009, the home would be worth $243,000, with an assessed value of $159,135. The tax would still go up next year.

If the market continues to fall for two or three years, taxes might go down, Linhares said, but he sees the real estate market leveling off. "I don't know if we'll ever get to the point where they meet," he said. "And if we did, it would be real depressing."

Measure 50 is a double-edged sword, he said. The limit kept taxes from rising while values were increasing, but now taxes will keep rising even as values are falling.

Property tax bills are due to come out soon, but homeowners shouldn't look for relief though property values are falling. Another factor: Voters approved new taxes. In Multnomah County, voters approved a Portland children's levy and bonds for Portland Community College and the Metro zoo last year. Bonds or levies were also approved for Centennial and Riverdale school districts, and the cities of Gresham, Troutdale, and Fairview.

It's the same story elsewhere in the metro area.

Washington County Assessor Rich Hobernicht explained that the average single-family home in the county had a market value of $330,000 last year, with an assessed value of $193,000.

The value calculations aren't finished for this year, but assuming a market loss of 10 percent, the average home would have a market value of $297,000 and an assessed value of $198,790.

Voters have approved new taxes in Washington County as well, including a bond issue for Tualatin Hills Park and Recreation District.

"People do not have a real good understanding of the mechanism," said Paul Warner, legislative revenue officer.

In approving Measure 50, voters wanted stability in the property tax system, Warner said.

In Oregon, as in the rest of the country, the properties that are falling the most in value are the ones that went up the most. Nationwide, cities like Las Vegas and Phoenix are hardest hit. In Oregon, the areas include parts of the Portland metro area and central Oregon.

"We are seeing significant declines, but we had such a huge appreciation in the market," said Scot Langton, Deschutes County assessor.

In 2006, the average assessed value of residential property in Deschutes County was 43 percent of market value. "That gap has narrowed considerably," Langton said. The ratio this year will be about 56 percent, similar to Multnomah County.

"We have individual properties that are getting closer," he said. Some bare lots platted in 2006 that remain undeveloped today have dropped in value by 50 or 60 percent, bringing market value down below assessed value.

For example, lots with a value of $150,000 in 2006 are selling for about $60,000 today, Langton said.

Next year, more properties in and around Bend might be close, but a typical homeowner still won't see their taxes go down, he said.

The situation is different in Clark County. Washington state has no limit on assessed value growth, but local government budgets can only grow by 1 percent a year without voter approval. So falling property values could reduce taxes for some homeowners, said Clark County Assessor Linda Franklin.

In Oregon, one factor that could drive down taxes is another mysterious wrinkle in the tax system known as "compression."

Measure 5, passed by voters in 1990, limits an individual property's tax rate to $10 per $1,000 of real market value and $5 for schools. When a property reaches the limit, taxes are reduced or "compressed" to bring them back down to the limit.

Linhares said the closer market value gets to assessed value, the more likely compression becomes.

In any case, taxpayers are going to be mad when they see their property values headed down and taxes headed up.

"But they are not going to blame you or me," Linhares said, "They are going to blame the assessor."

-- James Mayer