Finance Home

-

On June 20, 2023 the City Council adopted the Approved 2024-2025 Biennial Budget (with one change noted below) and 2024-2029 Capital Improvement Plan, in addition to performing several other budgetary actions. On May 30, 2023, City Manager John Williams presented the 2024-2025 City of West Linn Biennial Budget to the Budget Committee. Budget Committee Meetings took place on the dates listed below. Associated agendas, video links to watch, and budget documents can be found on the meeting pages below.

-

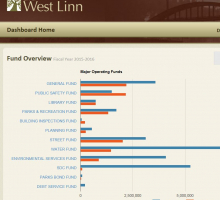

The City of West Linn's online dashboard displays financial information for City departments and programs. Data is updated daily from the City's financial management software and is presented in an easy-to-read display of revenue and expenditure information for the current fiscal year.

-

State law (ORS 294.336) mandates a budget committee for all Oregon local governments. The Budget Committee for the City of West Linn consists of the governing body plus an equal number of legal voters (community members of the Budget Committee) appointed by the City Council. Accordingly, West Linn has ten budget committee members, and the votes of all members are equal.

-

Capital Improvement Plan (CIP) documents are prepared to educate citizens about capital planning within the City’s financial forecast. Progressive organizations focus on capital planning because it allows for targeted, strategic financial decision-making that results in critical projects that leave a lasting impact on a community. West Linn has evolved over the years.

-

GFOA has developed a new financial management self-assessment tool, called the “FM Model”. It invites users to test their own financial management practices against public sector financial management best practices. FM Model contains over 50 “Good Practice Statements,” which are fundamental statements of how a government organization should operate its finances. Each Good Practice Statement is supported by a series of detailed evaluation questions – it is at this level that the self-assessment takes place.

-

Welcome to the beautiful City of West Linn! One of the first basic areas that you are probably interest in, is how to set your new home up with the various type of utility services. The City provides water, sanitary sewer, and surface water management services with separate entities that provide for garbage, electric and natural gas.